How Does Financing A Car Work

Looking to buy a new or used car but don’t have the funds to pay..

Read more

Australia’s most accessible financial broker

Car loans are a significant investment, one you want to make sure is suited to your particular needs before you sign on the dotted line. Knowing what type of car loan is the best fit for you requires knowing what to look for and what to avoid. Balloon payments are one of these factors you should consider carefully before you make a choice. Find out whether balloon payment car loans are a good idea for you below.

Deciding whether you want a balloon payment will help you narrow down loan and lender options. And give you a better idea of the loan terms you’re looking for.

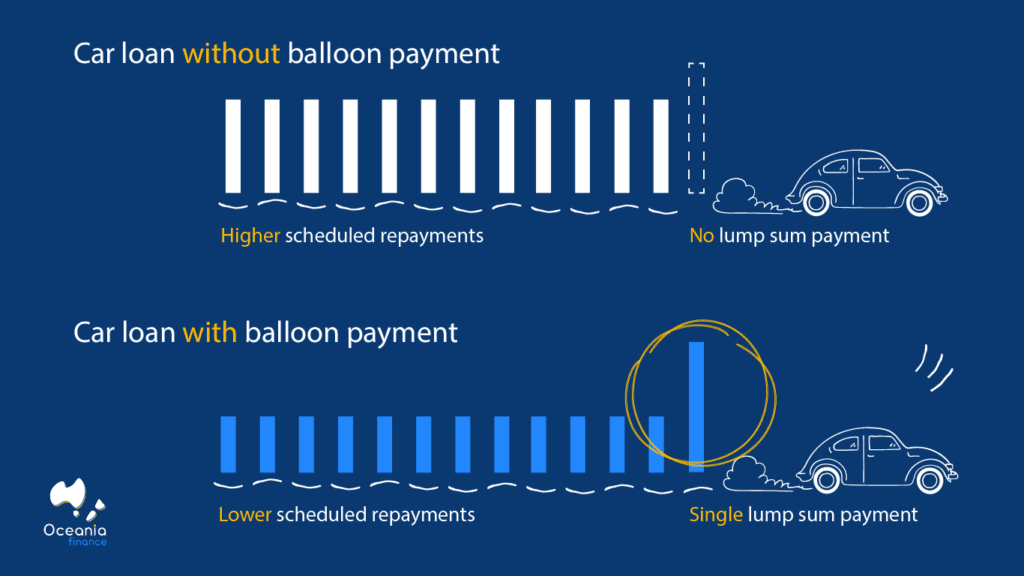

A balloon payment is an additional payment that you make at the end of your loan. When you have a balloon payment in place, your scheduled loan repayments cost less across the loan term.

Many lenders will offer optional balloon payments or include them as a requirement in the loan terms. You can also generally negotiate what percentage of your loan you would like the payment to be. This gives you more flexibility over your loan repayments and makes it easier to budget your expenses.

Bullet payments and balloon payments are similar because both are paid at the end of the loan. But balloon payments are only a percentage of your loan amount, whereas bullet loans are the total loan amount.

With a balloon loan, you still pay off the bulk of the loan in instalments. But the only thing you pay in instalments for a bullet loan is the interest. The actual money you borrowed, often referred to as the principal amount, you will pay in one lump sum at the end of the loan term.

It’s up to the lender to decide when a specific loan has a balloon payment attached. But generally, balloon payments are most common in business loans and car finance.

Having auto finance with a balloon payment attached can be broadly summed up in two steps:

Each lender calculates the residual amount you will need to repay differently. But we have included common examples below of what percentage you can expect to pay on your loan.

Balloon payments in Australia typically fall between 10-50% of the total loan amount. Often lenders will put a cap on the balloon payment amount for loans with longer terms.

| Car loan type | Loan amount | Loan term | Balloon payment (30%) | Monthly payment |

|---|---|---|---|---|

| No balloon payment | $45,000 | 5 years | N/A | $750 |

| Balloon payment | $45,000 | 5 years | $13,500 | $525 |

Assuming you were borrowing $45,000 on a 5-year loan, you could end up paying $225 less on monthly repayments with a balloon payment loan.

Does a balloon payment have interest? Sadly, yes it does. And because of this, you will end up paying more interest on your loan – even though your monthly payments are lower.

This is because interest is calculated daily based on the outstanding balance. Your balloon payment will increase the total balance you have left to pay for the whole life of your loan. So, each month you will be paying slightly more on interest than if you had a car loan without a balloon payment.

What are the benefits and drawbacks of getting a balloon payment car loan? Let’s break it down.

Pros |

Cons |

Lower scheduled repayment amounts |

Large sum left over to pay in one lump sum payment |

Able to afford a more expensive car |

Need to manage cash flow effectively and save enough for the balloon payment |

Potentially suitable for people with seasonal or other periodic cash flow boosts |

Pay more on interest over the life of the loan |

Frees up cash flow to use or invest in other things |

Will need to refinance, sell your vehicle, or use other ways to pay your balloon payment if you cannot afford it. |

Here are some key situations when balloon payment car loans could be a good idea:

Here are four options for how to pay a balloon payment if you can’t afford the outright cost:

If you’re still not sure if a balloon payment car loan is a good choice for you, reach out to a loan broker for personalised advice.

A personal car loan broker or business car loan broker can help you choose the best loan choices for your situation. They can also negotiate balloon payment terms with the lender on your behalf to get a loan agreement better suited to you.

Looking to buy a new or used car but don’t have the funds to pay..

Read more

Life often throws financial challenges our way. Things like home renovations, medical emergencies, and big-ticket..

Read more

Getting a small business loan can be a key step for entrepreneurs looking to start..

Read more